*This content was translated by AI.

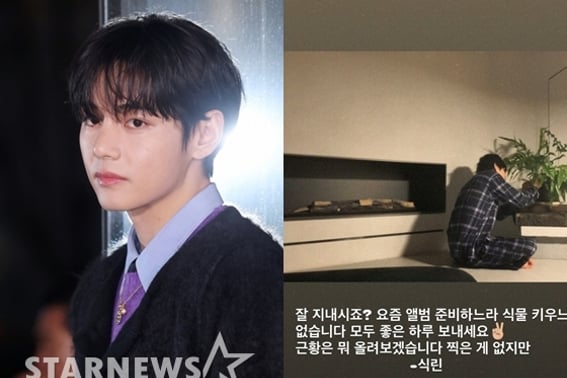

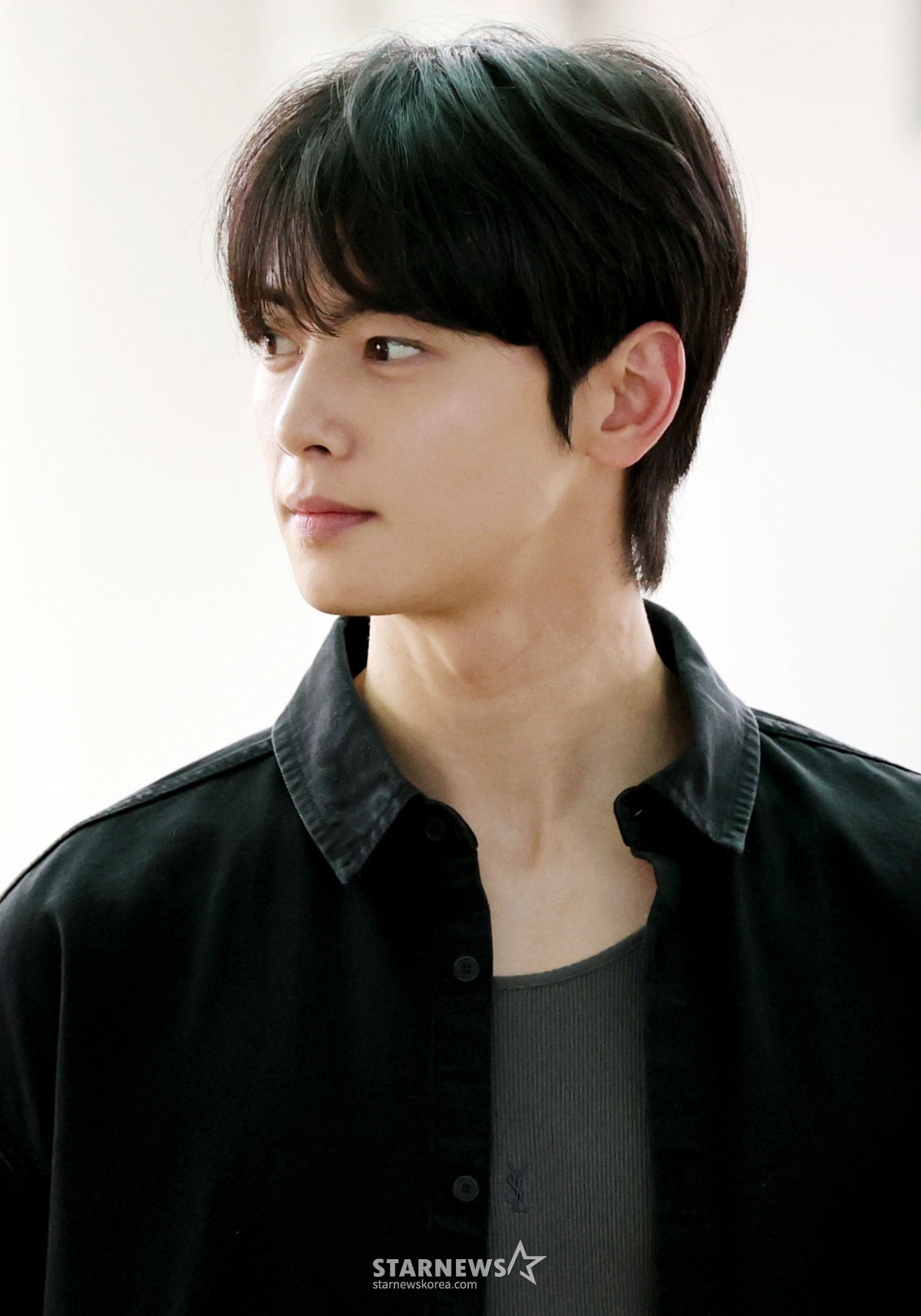

Regarding allegations that actor and singer Cha Eun-woo evaded taxes worth 20 billion won, a lawyer argued that the Cha Eun-woo family's actions could be judged as tax evasion.

Lee Don-ho, a lawyer representing Nova's law office, said in a video released on his YouTube channel on the 23rd, "As a result of the National Tax Service's investigation, suspicions were raised that he tried to distribute income through a corporation established by Cha Eun-woo's mother," adding, "He distributed income through a corporation established in his mother's name." On the surface, he pretended to be corporate income and said, "It is a suspicion that it is actually personal income."

"The first issue is whether the corporation actually did business. Even if the office manpower and work were real, it can be judged as tax evasion if a corporation was created to attribute the cost to the corporation and paid taxes after holding the cost to the corporation, he said. "Based on the principle of real taxation, we look at who actually made the money, not the name." "If profits are generated from personal labor and image, even the name of the corporation can be taxed as personal income," he said.

Lawyer Lee said, "However, just because you use a corporation does not mean that you will be evaded immediately. We need to comprehensively determine whether there was actual service, whether the contract structure was normal, and whether there was intention to avoid taxes, he said. "It will be an important case of showing the boundaries between tax savings and tax evasion to everyone for single-person businesses and family corporations."

Earlier, the Seoul Regional Tax Office conducted a high-intensity tax investigation against Cha Eun-woo in the first half of 2025 and notified him of the additional income tax of more than 20 billion won. This is the highest amount ever imposed on celebrities.

The National Tax Service said Cha Eun-woo and his mother, identified only by his surname Choi, used a trick to reduce income tax, which reached 45%, to apply a corporate tax rate that is more than 20% lower than the income tax rate by using a non-substantial company, DANI.

However, some argue that it is difficult to regard this as a clear tax portal because a corporation was established to pay a low tax rate corporate tax.

Under the current law, if the Act on Aggravated Punishment of Specific Crimes is applied, a portal tax of 1 billion won or more can be sentenced to life imprisonment or five years or more. However, if it is concluded as an underreporting due to differences in tax law interpretation or is defined as tax avoidance, it will be exempt from criminal punishment other than moral responsibility and tax collection.

In response, Cha Eun-woo's agency Fantagio said in an official position on the 22nd, "The main issue is whether the corporation established by Cha Eun-woo's mother is subject to real taxation. It is not a final and final issue, he said. "We will actively clarify issues related to the application of legal interpretation in accordance with due process."

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.