*This content was translated by AI.

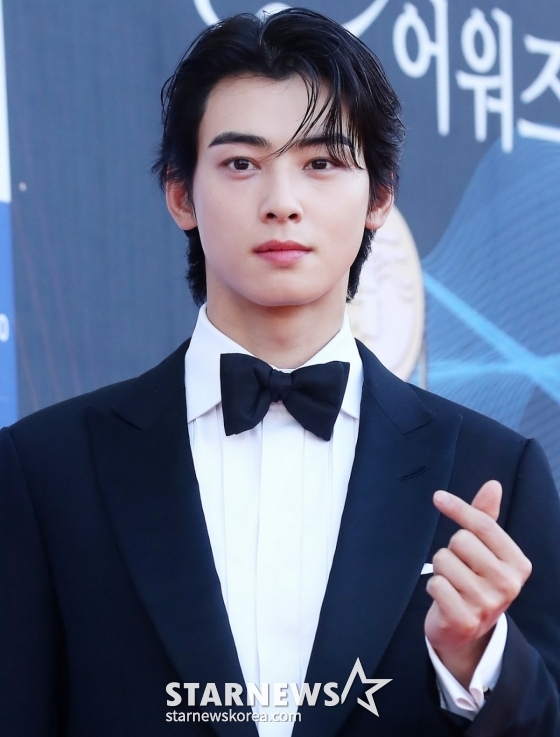

Regarding the controversy over the collection of 20 billion won in taxes on singer and actor Cha Eun-woo, a former tax accountant at the National Tax Service analyzed, "It is at an unprecedented level."

On the 25th, tax accountant Moon Bo-ra said on her YouTube channel, "How did Cha Eun-woo start with 20 billion tax evasion?It released a video titled '.

"The amount of additional fines sent to one celebrity is unprecedented in the history of the Republic of Korea," said Moon Bo-ra, a tax accountant. "Of course, it has not been confirmed that 20 billion won was evaded." So far, the National Tax Service is in a unilateral position," he said.

"Cha Eun-woo said he would fight back, but I don't think it will be easy to respond. This is because the four investigative countries, called "the underworld of the business world," were in charge of the investigation, he said. "It was a very scary place even when I was in the office. If the allegation of evasion is clear, it moves relentlessly. Since it is a special team in charge of irregularities, it comes in without prior notice. The fact that these four countries hit 20 billion won means that they are confident in the taxation logic," he added.

"Even if the corporation is created by my family, if the corporation moves according to the substance, this is a means of tax saving, and if you are a reasonable businessman, you can choose a tax saving method to reduce taxes," said Moon Bo-ra, a tax accountant. "However, the key point is that the National Tax Service viewed A corporation as a paper company without substance." How can you manage a big star named Cha Eun-woo at an eel restaurant. There is a huge gap between the industry and the place. Of course, the National Tax Service will not be able to admit the provision of services," he said.

In addition, regarding the change of the corporation from a stock company to a limited liability company, he said, "The National Tax Service sees something hidden. Adding a real estate rental business by changing it to a corporate location and a limited liability company can avoid heavy acquisition tax," he said.

The Seoul Regional Tax Office conducted a high-intensity tax investigation against Cha Eun-woo in the first half of 2025 and notified him of the additional income tax of more than 20 billion won. This is the highest amount ever imposed on celebrities. The National Tax Service said Cha Eun-woo and his mother, identified only by his surname Choi, used a trick to reduce income tax, which reached 45%, to apply a corporate tax rate that is more than 20% lower than the income tax rate by using a non-substantial company, DANI.

Under the current law, if the Act on Aggravated Punishment of Specific Crimes is applied, a portal tax of 1 billion won or more can be sentenced to life imprisonment or five years or more. However, if it is concluded as an underreporting due to differences in tax law interpretation or is defined as tax avoidance, it will be exempt from criminal punishment other than moral responsibility and tax collection.

Soon after, Cha Eun-woo's agency Fantagio said in an official statement on the 22nd, "The main issue is whether the corporation established by Cha Eun-woo's mother is subject to real taxation. It is not a final and final issue, he said. "We will actively clarify issues related to the application of legal interpretation in accordance with due process."

Cha Eun-woo expressed his apology in a lengthy article on the 26th, explaining the controversy over tax evasion and various suspicions related to the title of his "20 billion won notice of additional fine."

Cha Eun-woo said, "As a Korean citizen, I am deeply reflecting on whether my attitude toward tax obligations was strict enough," and added, "Over the past few days, I had time to reflect on myself, thinking about what I should say to those who were hurt by me to convey my apologies a little bit." "I was worried that the rambling writing would sound like an excuse or that it would cause fatigue, but I came to think that it is the right thing to do to speak and apologize for this issue."

Cha Eun-woo said, "I joined the military in a situation where I could no longer postpone it, and it was never an intentional choice to avoid controversy," adding, "Last year, I could no longer postpone my enlistment in the military, so I joined the military without completing the tax investigation process." However, I am deeply aware of the responsibility because this is also a misunderstanding that stems from my lack. If I were not a soldier, I would like to visit everyone who would have been affected by this incident and bow down and apologize, so I am writing this with all my heart," he said.

Cha Eun-woo said, "Over the past 11 years, I have been able to be in the position of 'Cha Eun-woo' because of the love and support you have generously sent me. Therefore, I feel indescribably sorry for causing great hurt and fatigue to everyone who has worked with me, even if I can't repay you for my lack of trust and support, he said. "I will faithfully work on the tax-related process that is going on in the future." In addition, we will humbly accept the results according to the final judgment made by the relevant agency and fulfill our responsibilities accordingly.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.