*This content was translated by AI.

The court said, "Former ADOR CEO Min Hee-jin seems to have set up a plan to participate in the stake after the independence and control of ADOR."

The Civil Agreement Department 31 (Director Nam In-soo) of the Seoul Central District Court held a court ruling on the 12th to confirm the termination of the inter-shareholder contract filed by Hive against former CEO Min Hee-jin and a lawsuit filed by former CEO Min Hee-jin against Hive for the exercise of put options.

The court said, "It is recognized that Min Hee-jin has sought a way to independently dominate ADOR. It seems that he planned to leave the ADOR with consent in anticipation of the breakdown of negotiations on the contract between shareholders. This fact alone cannot be regarded as a serious violation of the contract between shareholders. If the negotiations break down, it seems that they tried to buy the stake in ADOR at a low price, saying that if they exercise the put option and go out, it will become an empty shell, and the purchase price seems to be around 800 billion won to 1.5 trillion won. Through this, I think we have established a plan to participate in the stake," he explained.

"According to the contents of Kakao Talk secured by the police, it is assumed that Min Hee-jin, the representative of the contract between shareholders, has exercised put options after five years of normal maturity, and that the assumption of ADOR's stock listing or the sale of ADOR's stake is based on Hive's approval, which seems reasonable in the review," he said.

After announcing his position in November 2024, former CEO Min Hee-jin announced that he would resign as an in-house director of ADOR, he immediately notified the exercise of about 26 billion won in put options (the right to buy and sell stocks at a certain time at a predetermined price) and filed a lawsuit for payment accordingly. The legal value amounts to 28.7 billion won.

The put option is one of the key elements of former CEO Min Hee-jin's inter-shareholder contract with Hive, and under the contract, ADOR's average operating profit multiplied by 13 times in the previous two years can receive an amount equivalent to 75% of its stake from Hive. According to the ADOR audit report released in April 2024, former CEO Min Hee-jin holds 573,160 shares (18 percent) in the ADOR. Based on this calculation, former CEO Min Hee-jin is known to receive about 26 billion won. However, Hive said it notified former CEO Min Hee-jin of the termination of the contract between shareholders, which is the basis for the put option, in July 2024.

In a statement released at the time, former CEO Min Hee-jin said, "We will terminate the inter-shareholder contract signed with Hive and hold Hive legally responsible for violations of the inter-shareholder contract," adding, "We will take necessary legal measures one by one for the numerous illegalities of Hive and its people." "Despite the hellish dispute with Hive that began with Hive's illegal audit for more than seven months, I have been doing everything I can to keep the contracts between shareholders and return ADOR to where it was before (illegal audit). However, Hive has so far refused to admit his wrongdoing and there is no sign of change, so I decided that further efforts were a waste of time," he explained.

Former CEO Min Hee-jin said, "Hive's 2024 atrocities will be recorded as an unprecedented issue in K-pop history," adding, "A person's malicious behavior should not undermine the 'essence of business'. It was really bad," he added.

In response, Hive claimed that the shareholder contract was terminated in July 2024, and responded by saying that Min Hee-jin's put option rights were also extinguished.

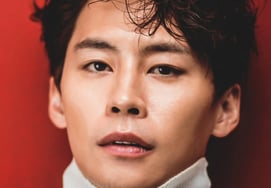

Former representative Min Hee-jin appeared at the court in September 2025 in a large taxi for the person concerned's own newspaper, drawing attention. Former representative Min Hee-jin entered the courtroom without answering reporters' questions, and CLO (Chief Legal Officer) Jung Jin-soo attended as a witness on Hive's side. It was the first time the two sides have met face-to-face since Hive began an audit of former representative Min Hee-jin in April 2024.

CLO Jung Jin-soo, who served as a witness, disclosed Min Hee-jin's suspicious activities, citing former CEO Min Hee-jin's request to increase the number of put options from 13 times to 30 times, receiving a tip that he was planning for independence, and finding various documents that Min Hee-jin was writing at the time as a result of the ADOR audit. It also claimed that Min Hee-jin met with Japanese investors and received advice regarding shareholder contracts, although it did not disclose his personal information.

In response, former CEO Min Hee-jin asked, "Isn't it a strange thing for a company's representative to meet an investor?" but Jung Jin-soo said, "The intention is a little different," believing that Min Hee-jin hid the meeting with the investor. Min Hee-jin, former CEO, also directly responded, "perjury," when CLO Jung Jin-soo claimed that he expressed the possibility of changing some of the shareholders' contracts, including the clause banning competition.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.

![He opened his Hive that lost to Min Heejin.."We're going to appeal." [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026021213474465488_1.jpg)

![Byun Yo-han's marriage, Moon Sang-min's first movie, Goa-sung's new face.."Pavanne" of youth [synthesis]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026021213372065929_1.jpg)

!["Cured up for thyroid cancer." Jin Tae-hyun completed 7km. "Asymptomatic painless." [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026021207104621141_1.jpg)

![Seo Jung-hee and daughter Seo Dong-ju have 11 private lessons.."The price of a building in Gangnam" [What's the point of leaving it]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026021122441845078_1.jpg)