*This content was translated by AI.

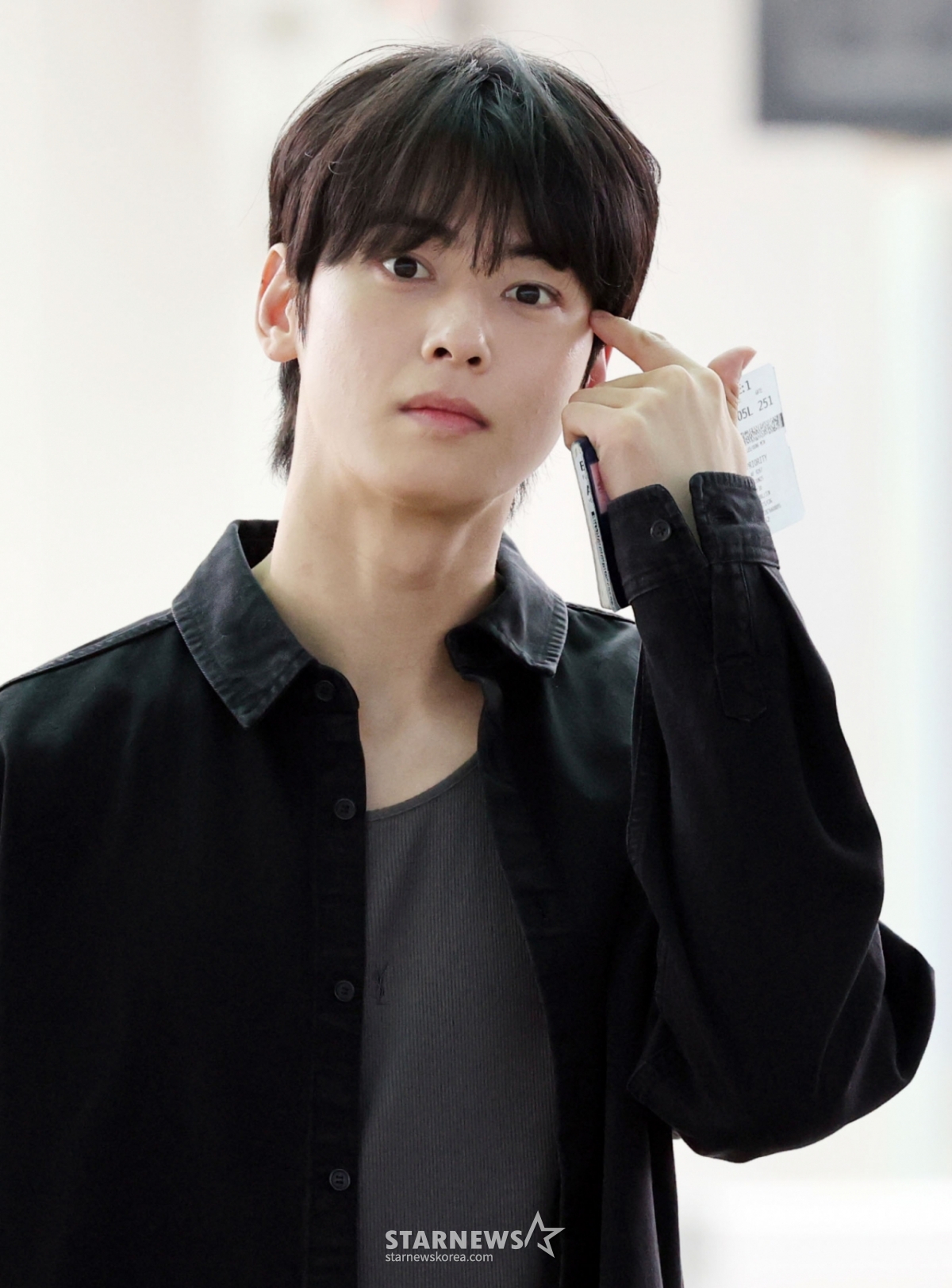

Amid allegations of tax evasion by group Astro member and actor Cha Eun-woo, the controversy is growing after it was confirmed that a corporation run by his mother changed its organization from a stock company to a limited liability company. Some point out that it is a choice to avoid external surveillance.

According to Star News' confirmation on the 23rd, Cha Eun-woo's mother, Choi, moved her headquarters from Anyang, Gyeonggi-do to Gimpo, Gyeonggi-do, in June 2020, and then moved back to Ganghwa, Incheon, in June 2022. Ganghwa, Incheon, is known as the location of an eel restaurant run by Cha Eun-woo's parents. After that, the corporation changed its organization from a corporation to a limited liability company in September 2024, and changed its corporate name to "DANI Limited Liability Company." Record wholesale, video record manufacturing, management, entertainment agency, entertainment assistance, restaurant, real estate rental and sale, accommodation and restaurant businesses were specified for business purposes.

Cha Eun-woo recently caused a big stir when he was notified of more than 20 billion won in tax collection by the National Tax Service, and critics say that the organizational change is a measure to avoid monitoring by tax authorities.

Limited liability companies are in the form of companies introduced by the revision of the Commercial Act in 2011, and are only responsible for the amount invested by employees. Initially, it was intended to support the autonomous operation of venture companies and IT companies, but it has been excluded from external audits and financial statements disclosure until now. As a result, it has been steadily pointed out that it is vulnerable to controversy over accounting transparency because it is difficult to grasp the financial status or taxation details from the outside.

Therefore, there are concerns that if a single celebrity agency or family corporation, which has grown in size, switches from a stock company to a limited liability company, it could raise suspicions that it is trying to avoid transparent accounting verification.

According to a media outlet earlier, the National Tax Service reported that Cha Eun-woo had tax evasion through a corporation established by his mother, and notified Cha Eun-woo of an additional income tax of more than 20 billion won. Cha Eun-woo has been working in a structure in which his agency Fantagio and a corporation established by his mother sign a service contract to support entertainment activities, and the profits are reportedly divided and attributed to Fantagio, the corporation, and Cha Eun-woo.

The National Tax Service believes that the corporation is inappropriate for performing entertainment management, and sees it as a trick to disperse income through a non-substantial "paper company." In addition to Fantagio, Cha Eun-woo signed a service contract by setting up a separate family company, which is more than 20 percentage points lower than the income tax rate of 45 percent.

Cha Eun-woo's additional amount is reported to be the highest ever in terms of individual celebrities compared to Lee Ha-nee (6 billion units), Yoo Yeon-seok (3 billion units), Cho Jin-woong (1.1 billion units), and Lee Joon-ki (900 million units).

In this regard, the agency Fantagio said in an official position, "The main issue is whether the corporation established by Cha Eun-woo's mother is subject to real taxation, and it is not currently finalized and announced," adding, "We will actively explain issues related to the interpretation and application of the law in accordance with due process."

"The artist and tax representative will cooperate faithfully so that the process can be completed as soon as possible," he said. "As one of the people, Cha Eun-woo promises to faithfully fulfill his tax returns and legal obligations."

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.