*This content was translated by AI.

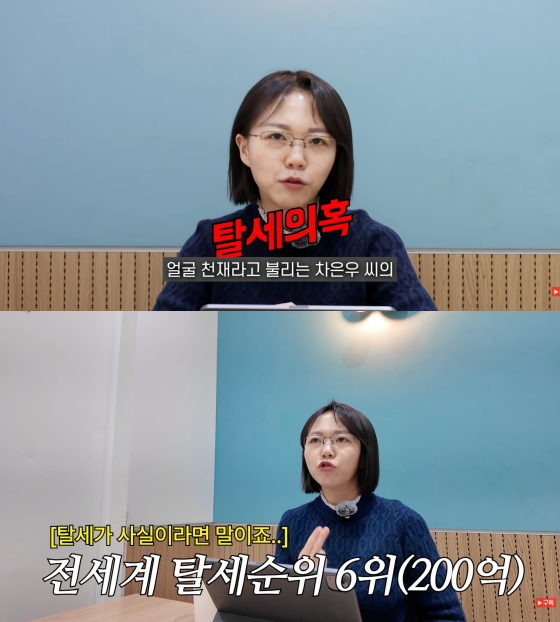

While actor and singer Cha Eun-woo is embroiled in allegations of income tax evasion worth 20 billion won, a former tax accountant, a former investigator, has made an analysis related to this.

Moon Bo-ra, a former investigator at the Seoul Regional Tax Office, posted a video on her YouTube channel on the 24th to analyze Cha Eun-woo's alleged evasion of 20 billion won.

Regarding the size of the additional fine for Cha Eun-woo, tax accountant Moon said, "The additional fine sent to one celebrity is unprecedented in the history of the Republic of Korea."

The Seoul Regional Tax Office's investigation bureau, which is called the underworld of the business world, was in charge of it. This is a place where we move relentlessly if the allegations of evasion are judged to be clear," he said.

"There is no problem with the structure itself of establishing a corporation to share profits, but the National Tax Service viewed corporation A, owned by Cha Eun-woo's mother, as a paper company without substance," said tax accountant Moon, looking at the core of the controversy.

It was also noted that the location of the corporation's business was an eel restaurant in Ganghwa Island. "How can you manage a big star named Cha Eun-woo in a place where there is only the smell of grilling eels without office fixtures or human facilities?" said tax accountant Moon. The gap between the industry and the place is very large," he pointed out.

Recently, it was revealed that Cha Eun-woo was notified of more than 20 billion won in tax collection by the National Tax Service, which caused a big stir. In the first half of last year, it was reported that it was investigated by the Seoul Regional Tax Office on tax evasion charges.

In particular, the National Tax Service judged that tax evasion was carried out through corporation A established by Cha Eun-woo's mother. Cha Eun-woo reportedly worked in a structure in which his agency Fantagio and his mother's corporation A signed a service contract to support entertainment activities, and the profits were divided and attributed to Fantagio, the corporation, and Cha Eun-woo.

The National Tax Service believes that corporation A was deemed inappropriate to perform entertainment management tasks and used a trick to disperse income through a non-substantial "paper company." Cha Eun-woo signed a service contract with a separate family company in addition to his existing agency Fantagio, which was applied with a lower corporate tax rate of more than 20 percentage points instead of the income tax rate of 45 percent.

In this regard, Fantagio said, "The main issue is whether the corporation established by Cha Eun-woo's mother is subject to real taxation," adding, "It is not currently finalized and announced, and we will actively explain issues related to legal interpretation and application in accordance with due process."

Cha Eun-woo joined the army in July last year and is currently serving as an army military band.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.