*This content was translated by AI.

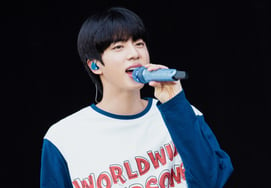

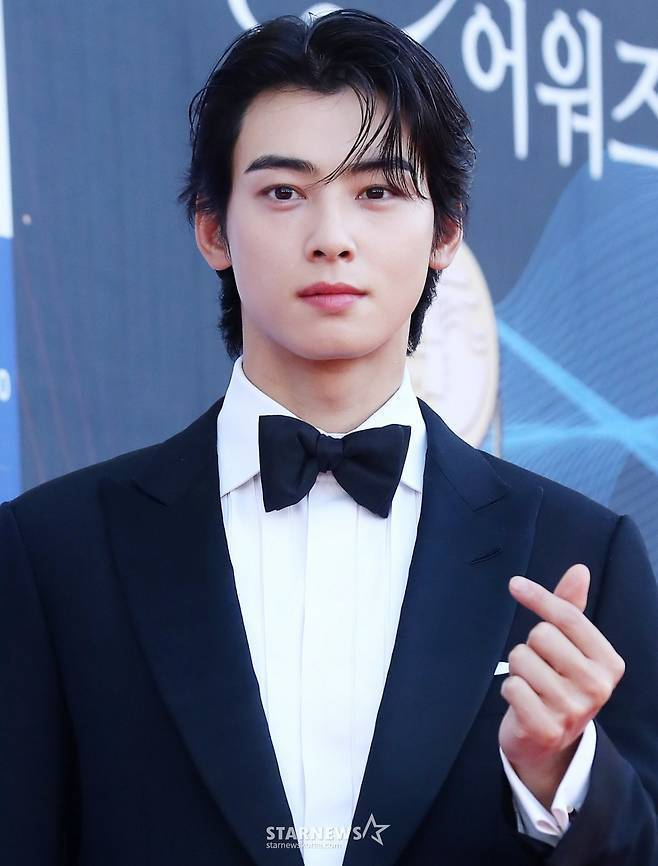

While singer and actor Cha Eun-woo is embroiled in allegations of income tax evasion worth 20 billion won, an incumbent lawyer analyzed the controversy.

Lawyer Kim Myung-kyu recently appeared on the YouTube channel "Nalidge Studio" and analyzed Cha Eun-woo's alleged evasion of 20 billion won.

Regarding the huge additional 20 billion won, lawyer Kim said, "I thought the amount of the main tax would be smaller than 20 billion won. In the case of an unfair underreporting penalty due to fraud or other illegal methods, a 40% additional tax rate is applied. "When I calculated it backwards, I thought about 10 to 14 billion won was the main tax, and I estimated that the remaining 6 to 10 billion won would be an additional tax," he said.

"At first, the additional fine would have been higher than 20 billion won," he said. "The reduced amount is 20 billion won, and the primary workshop is already over. Investigation countries 1, 2, and 3 are the places to investigate regular, general, and property taxes, and investigation countries 4 are the places to conduct irregular special tax investigations. I understand that it is a place to enter (investigate) only when there is a large-scale corruption or specific tax evasion charges, and only when criminal charges are different. You can think of the weight class of the allegations as different," he said.

He also mentioned Cha Eun-woo's agency Fantagio. Lawyer Kim said, "Don't the other party exist in terms of the flow of funds. In the process of investigating Fantagio, the flow of funds with single-person agencies may have been spotted as strange. I think it has moved on to an irregular tax investigation through that," he speculated.

We looked at Fantagio's financial statements and financial structure, and from at least 2020, Fantagio's financial condition is very bad, so it can be considered as a serious patient. Since that year, the net loss has continued and the deficit has continued to accumulate. There is an operating loss from 2022. And at the beginning of 2022, about 58 billion of the (capital) of about 64.6 billion was transferred free of charge. Then, they issued convertible bonds twice. It was a very bad signal," he explained.

"Unfortunately, Cha Eun-woo's renewal is at the end of 2022," he said. "From Fantagio's point of view, he must have been a big entertainer who should not be missed. I don't know who would have suggested this deformed structure first, but I think Fantagio had no choice but to accept it," he claimed.

Meanwhile, in the first half of last year, Cha Eun-woo was under intense investigation by the Seoul Regional Tax Office on tax evasion charges, and the National Tax Service recently notified about 20 billion won in tax collection.

The National Tax Service judged that tax evasion was carried out through corporation A established by Cha Eun-woo's mother. Cha Eun-woo reportedly worked in a structure in which his agency Fantagio and his mother's corporation A signed a service contract to support entertainment activities, and the profits were divided and attributed to Fantagio, the corporation, and Cha Eun-woo.

The National Tax Service believes that corporation A was deemed inappropriate to perform entertainment management tasks and used a trick to disperse income through a non-substantial "paper company." Cha Eun-woo signed a service contract with a separate family company in addition to his existing agency Fantagio, which was applied with a lower corporate tax rate of more than 20 percentage points instead of the income tax rate of 45 percent.

The core of this controversy is whether corporation A is involved in Cha Eun-woo's profit distribution process. In addition to the fact that the entity of the corporation is actually an "eel restaurant" run by Cha Eun-woo's mother, the controversy has intensified as Cha Eun-woo has introduced the eel restaurant as a "dangol restaurant."

In response, Cha Eun-woo said on social media on the 26th, "I sincerely bow down and apologize for causing concern and disappointment to many people due to various things related to me recently. "With this incident, I am reflecting on myself and deeply reflecting on whether my attitude toward the duty of tax payment as a citizen of the Republic of Korea was strict enough," he said.

In addition, Fantagio said, "The main issue is whether the corporation established by Cha Eun-woo's mother is subject to real taxation," adding, "It is not currently finalized and announced, and we will actively explain issues related to legal interpretation and application in accordance with due process."

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.