*This content was translated by AI.

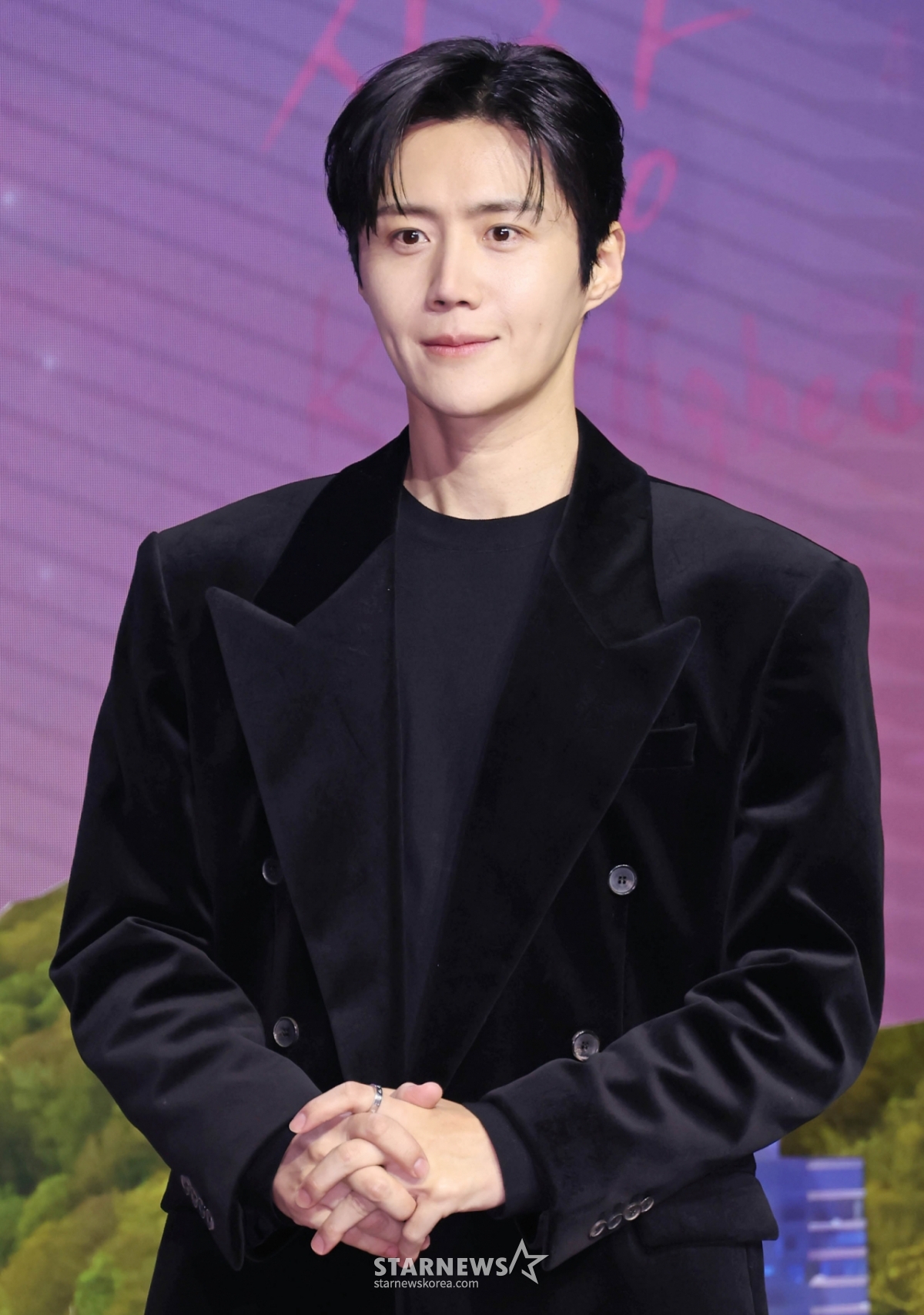

Actor Kim Sun-ho's alleged tax evasion has been raised.

On the 1st, Sports Kyunghyang reported that tax evasion was detected by Kim Sun-ho, who established a corporation with his family as an executive, paying processing labor costs and using corporate cards privately.

According to this, Kim Sun-ho established a separate performance planning corporation in January 2024 at his home address in Yongsan-gu, Seoul. Kim Sun-ho's parents are registered in the internal directors and auditors of the corporation, and the board of directors is reportedly composed of only family members without external professional managers.

In addition, Kim Sun-ho reportedly used corporate funds to pay his parents tens of millions of won in salary, and there is a circumstance that the money was transferred back to Kim Sun-ho. Suspicions of private misappropriation were also raised, such as Kim Sun-ho's father paying for cigarettes with a corporate card or using them at a karaoke bar.

In particular, it was reported that the address of the corporation was the same as that of Kim Sun-ho.

In this regard, the agency Fantagio said, "We are organizing our position."

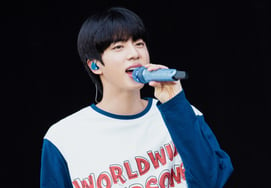

Meanwhile, singer and actor Cha Eun-woo, who belongs to Fantagio such as Kim Sun-ho, has also recently been embroiled in allegations of tax evasion. The tax authorities reportedly notified Cha Eun-woo of the additional 20 billion won after determining that he evaded income tax using a corporation in his mother's name. In particular, controversy intensified when it was revealed that the address of the corporation was registered as a restaurant in Ganghwa Island operated by his mother.

Cha Eun-woo, who is currently serving in the military, said on his SNS, "With this incident, I am reflecting on myself and deeply reflecting on whether my attitude toward tax obligations as a citizen of the Republic of Korea was strict enough." We will also humbly accept the results according to the final judgment made by the relevant agencies and fulfill our responsibilities accordingly," he said.

In this regard, Fantagio said, "The current issue is being fact-finding in accordance with the tax authorities' procedures, and the agency and the artist are faithfully investigating within the scope of their respective needs. If legal and administrative judgments become clear in the future, we will responsibly implement necessary measures according to the results.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.