*This content was translated by AI.

The Korea Entertainment Management Association (Han Mae-yeon) directly expressed its position on the establishment of a celebrity corporation and the controversy over taxes.

Han Mae-yeon said on the 12th, "As the issue of tax evasion over the establishment of a corporation of celebrities has recently come under fire, there are many voices of concern across the entertainment industry," adding, "As K-content has become the leading role in the global market, the structure of the Korean entertainment industry is twisted." In particular, there is a significant difference in the temperature between the tax authorities and the industry as suspicions of tax avoidance have recently emerged in conjunction with the issue of establishing a corporation of Hallyu stars.

Han Mae-yeon said, "The current taxation administration uniformly regards corporations as paper companies to avoid the progressive income tax rate, and repeats extensive post-collection under the name of the real taxation principle. This approach clearly shows that institutions and administrations are unable to keep up with the changing structure while ignoring the reality of the industry," he said, adding, "The agencies are not just so-called 'shells' that are only involved in taxes. It functions as a company that represents some of the rights of celebrities while playing various roles," he explained.

"The reason why the post-mortem collection is repeated at present is not the 'malice' of the corporation, but the 'absence of standards'. The reason why the National Tax Service's additional punishment is repeatedly overturned in administrative litigation and tax trials is not because the industry uses expediency, but because there are no clear and predictable standards. "Now, it is necessary to change the system to recognize artists as a brand and a corporate entity that operates intellectual property, away from the view that they still view artists as "private businesses."

At the same time, Han Mae-yeon suggested to the government △ establishing clear taxation guidelines that recognize the industrial substance of individual corporations △ establishing predictable taxation standards reflecting the actual role, risk burden, and business structure of corporations △ improvement of systems that induce transparent operation rather than focusing on crackdowns and additional collection △ proactive administrative interpretation and policy decisions that do not hinder the global competitiveness of the K-culture industry.

[A statement from the Korea Management Association on the establishment of a corporation and taxation of celebrities]

As K-content has become the leading role in the global market, there is a reaction that the structure of the Korean entertainment industry is distorted. In particular, there is a significant temperature difference between the tax authorities and the industry as suspicions of tax avoidance have recently emerged in conjunction with the issue of establishing a corporation of "Korean Wave stars."

1. What's wrong with establishing a corporation for celebrities?

Existing entertainment agencies, which began to predict the industrial success of popular cultural contents as the wind of the Korean Wave began to blow in the 1990s, have established a system as a comprehensive entertainment company that encompasses planning, production, and management for the success of their celebrities. This has maximized the value of celebrities in a more efficient way and has sparked the rapid growth of the pop culture and arts industry.

Korea's unique entertainment system is basically a so-called one-stop system in which individual celebrities and companies sign exclusive contracts, and the company proceeds from the first stage of individual celebrities to the management of finally debuted celebrities.

The problem began to arise as the industry grew dramatically and the Korean Wave began to gain sensational popularity around the world. Individuals have become entrepreneurship that generates astronomical profits. However, no institution or policy has understood and supported this structure, which has also begun to serve as an opportunity to drastically change the structure of the entertainment industry. The so-called artists themselves began to establish and manage the so-called "personalized corporation" to manage their careers, intellectual property rights (IP), and long-term brand values.

However, the current taxation administration uniformly regards these corporations as 'paper companies' to avoid the progressive income tax rate, and repeats extensive post-collection under the name of the real taxation principle. This approach clearly shows that institutions and administrations are unable to keep up with the changing structure while ignoring the reality of the industry.

2. How should I view a celebrity's private corporation?

The agencies are not just so-called 'shells' involved in taxes. It functions as a company that represents some of the rights of celebrities while playing various roles.

• Mental care and long-term career management of artists

• IP Development and Content Planning

• Direct liability for penalties and damages arising from exclusive contracts and contribution contracts

• Actual management activities, such as office rental, full-time manager employment, and exclusive vehicle operation, etc

These activities are carried out directly, and even in actual courts, corporations are gradually recognized as substantial corporations based on the case of conducting practical business, becoming the subject of contractual responsibility, and establishing their own business model.

3. So how should it be changed?

Currently, the reason why post-collection is repeated is not the 'malice' of the corporation, but the 'absence of standards'. The reason why the National Tax Service's additional disposition is repeatedly overturned in administrative litigation and tax trials is not because the industry uses expediency, but because there are no clear and predictable standards. Therefore, it is now necessary to move away from the view that artists are still viewed as "private businesses" and to recognize them as a brand and a corporate entity that operates intellectual property.

4. a suggestion of a smoke

Accordingly, the Korea Management Association makes the following suggestions to the government.

• Establish clear taxation guidelines for individual corporations that recognize industrial substance

• Establishment of predictable taxation standards reflecting the actual role, risk burden, and business structure of corporations

• Improvement of the system that induces transparent operation rather than focused on crackdown and additional collection

• Forward-looking administrative interpretation and policy decisions that do not hinder the global competitiveness of the K-culture industry

5. concluding words

K-Culture is no longer an individual achievement of some stars, but a future industry and national brand of Korea

As soon as we cut the structure that led to that growth into the frame of tax evasion, we will turn off the growth engine ourselves.

On the premise of transparent operation, the Korea Management Association earnestly appeals to the people and the government to recognize the reality of the industry and improve the system.

Thank you.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.

![Rusty Song Chae-ah exposed the atrocities of her former agency, "Demand for Internet broadcasting.."Debt even if you breathe" [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026021211310297159_1.jpg)

!["My temper is dirty." Kim Yong-gun's '21-month-old' grandson was attacked by malicious comments..Hwang Bo-ra, "Open stuffed." I'm flattered [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026021211141072670_1.jpg)

![Divorce, retirement..Hwang Jae-gyun's "New Start" celebration exploded [Official]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026021210493690837_1.jpg)

![Jeong Eun-pyo, 'A rich harvest of children,' went to the hospital, saying, "My wife's face is not good, her knee that was holding out well.." [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026021215150577254_1.jpg)

![Hwang Hee-chan's sister Hwang Hee-jung is on the verge of getting off "The Girl at the Golden Age"..SBS "Discussion Not Yet" [Official]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026021215251794135_1.jpg)

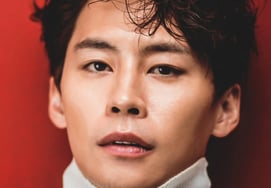

![Kim Min, an actor that I'm looking forward to in the future [★ Photo]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026021215410345099_1.jpg)