*This content was translated by AI.

"I made a stock account for my baby!"

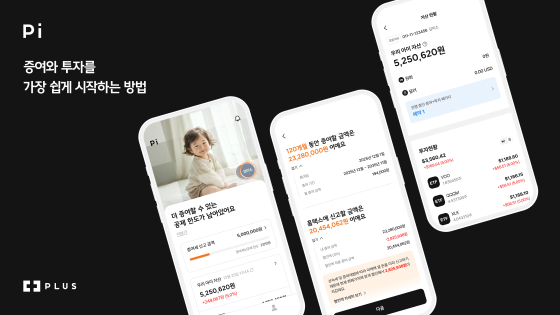

Hanwha Life Insurance announced on the 5th that it has launched "Pi," a gift and investment platform for children and parents. Hanwha Life is the first service to provide gift, investment, and tax services for underage children in one stop.

If the existing financial sector's child-related services stayed in opening accounts and transferring funds, Pi is characterized by connecting not only the donation of assets for children but also the management of assets that continue after the donation. The timing of donation by growth stage, asset investment, and tax management were structured by time point.

The launch is the result of implementing data and technology-based financial solutions aimed at the co-brand "PLUS (plus)" [1] of Hanwha Financial affiliates. Based on PLUS' philosophy, Pi solved parents' concerns about their children's economic independence with data technology.

The first step is to establish a gift plan. If you enter the target amount and period based on the limit of exemption from gift tax for underage children (20 million won in total for 10 years), the Pi app automatically calculates the remaining deduction limit. It is possible to establish a gift plan that minimizes the tax burden without checking the complicated calculation method one by one.

It is also simple to invest in gifted assets. Through collaboration with Hanwha Investment & Securities, it will provide one-stop support for overseas stock and ETF investments as well as opening non-face-to-face securities accounts under children's names within the app. The donated assets can lead to actual management without staying in the deposit bankbook.

"Pi" is a platform that allows anyone to easily and conveniently design a child gift plan by paying attention to the needs of young parents who are interested in managing their children's assets," said an official at Hanwha Life Insurance, who spoke with this newspaper on the phone.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.

![In addition to elbow surgery, Yoo Shin-go, "I want to stand next to KBO and Won Tae-in rather than ML."" [Interview]](https://menu.mt.co.kr/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/upload/main/2026/2026020412504224712423_mainSub2.jpg)

![[a freshman in the vocal department] 1. From "Vocal Teacher" to "Vocal Trainer"](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026020211241941976_1.jpg)