*This content was translated by AI.

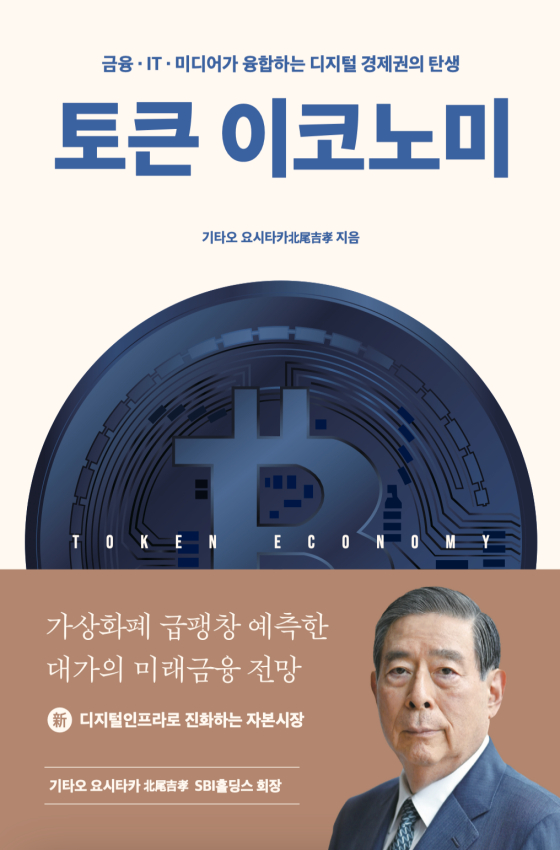

- Bitcoin ETF, stablecoin, token securities..must-read in the age of digital assets'Token Economy' - Age of digital assets, read birth of new financial order

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs, opening a new chapter for global financial markets. It was a historical moment when cryptocurrency, which had been regarded only as an object of speculation, was incorporated into the realm of institutional finance.

After the decision, institutional investors' funds began to flow rapidly into the virtual asset market, and the global total supply of stablecoins exceeded $250 billion (about 345 trillion won) as of the first half of 2025. Now digital assets are no longer a concept of the future. At this very moment, it is a reality that is fundamentally changing the order of global finance and capital markets.

In this era of huge transformation, Japanese financial industry great Yoshitaka Kitao, chairman of SBI Holdings, will view the essence and future of the digital asset revolution through the "Token Economy," and Money Today Broadcasting (MTN) will publish the Korean version of the "Token Economy."

The author does not simply talk about the price outlook or investment techniques of cryptocurrency. Instead, it analyzes how digital assets are moving to the center of the global economy from the macro perspective of structural changes in technology, policy, and monetary hegemony. The new financial paradigm represented by Bitcoin, Stablecoin, Token Securities, and Web3 provides insight into how our assets, investments, and even our way of life will change.

Chairman Yoshitaka Kitao is the best person to write this book. He started his financial career at Nomura Securities in 1974 and grew into an expert in international finance, and joined Softbank in 1995 at the invitation of Chairman Son Jeong-ui to share the rapid growth of the Japanese IT industry. In 1999, SBI Holdings was established to become Japan's largest Internet comprehensive financial group. Currently, SBI Group has global influence in securities, banks, insurance, asset management, as well as blockchain and digital assets. With 52 million customers in Japan as of 2024, SBI Holdings is Japan's fifth-largest financial holding company with a customer base equal to half of the country's population.

Particularly noteworthy is the fact that Chairman Kitao is a pioneer in the field of digital assets. He has invested in the issuer of virtual asset Ripple (XRP) since the beginning, and has been actively investing and expanding the business at the SBI Group level, seeing the possibility of financial innovation in blockchain technology early on.

His perspective, which combines nearly 50 years of financial experience and hands-on experience in digital assets, is different from that of scholars and theorists. In fact, it is the voice of field experts who have led the front lines of digital finance while managing the assets of tens of millions of customers.

The 'Token Economy' declares the birth of a digital economy where finance, IT, and media converge. The book deals with key topics such as market changes that Bitcoin spot ETF approval will bring, competition for hegemony between stablecoins and CBDCs, the future of capital markets changed by token securities (STO), and the grand integration of finance, IT, and media in the Web3 era. In addition to the practical case of the digital asset strategy that SBI Group has actually promoted, it provides a comprehensive perspective that encompasses theory and practice.

In the book, the author said, "If the Internet has changed the world, digital space is rewriting the 'world of money and value' itself. The impact is comparable to the Internet, or maybe even more." Just as the Internet revolution in the 1990s completely changed the way information was distributed and communicated, the ongoing digital asset revolution redefines the way money and values are moved. In an era of faltering dollar hegemony, a new monetary order is coming, and we are at the crossroads of deciding which currency to believe in and which assets to choose.

The publication of this book is also timely in Korea. In Korea, discussions on institutionalization of token securities are in full swing, and policy reviews are underway on the introduction of Bitcoin spot ETFs and the issuance of won-based stablecoins. Major financial holding companies are scrambling to propose securing competitiveness in stablecoins and digital assets as a key strategy for the new year. At this time of transition, Kitao's insight into the digital assets business at the forefront of the Japanese financial industry will be a valuable compass for investors, financiers and policymakers alike.

Kim Seo-joon, CEO of Hashed, described the book as "the future of a 'tokenized economy' viewed by a traditional finance master," and said, "I highly recommend it to everyone who is thinking about what to prepare for this huge transition period." Chung Yoo-shin, head of the Korea Fintech Support Center, also sent a recommendation, saying, "He is an insightful leader who predicted the explosive growth of the virtual currency market," adding, "I predict that the token economy will be a transformation of the civilization structure."

"Token Economy" will be a must-read for investors who want to understand the nature of investing in digital assets, financiers who want to know how blockchain changes the financial system, entrepreneurs preparing token economy businesses, and experts who want to read the intersection of macroeconomic and technological trends. Are your assets safe. This book gives a realistic direction to the question.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.

!["Out of the grammar of K-pop labels" Min Hee-jin, OK Records, officially launched [Official]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020410084447389_1.jpg)

!['Paco' is more famous than the Eiffel Tower..The first guest of "Welcome" after the rearrangement [Official]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020409271155499_1.jpg)

![Rhythm Power Earthman, his brother is dead..Protecting the mortuary. "I miss you already." [Professional]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020317524446431_1.jpg)

![Kim Sun-ho, "Parents' salary, I returned it"An open apology ending [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026020412072721383_1.jpg)

![Kim Ho-young cancels the musical urgently on the day of the musical "Sorry for causing concern.."Flu type B" [Professional]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026020412021699401_1.jpg)