*This content was translated by AI.

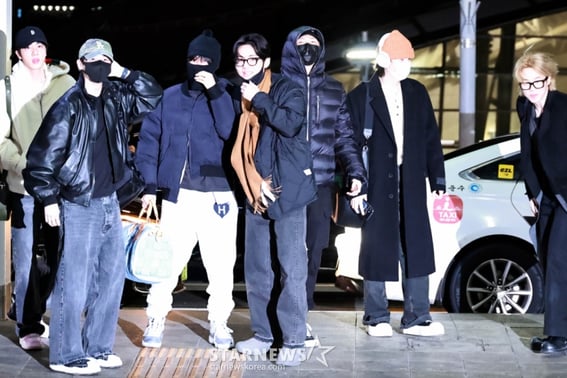

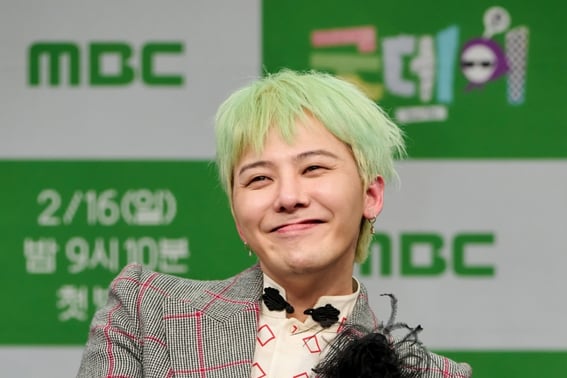

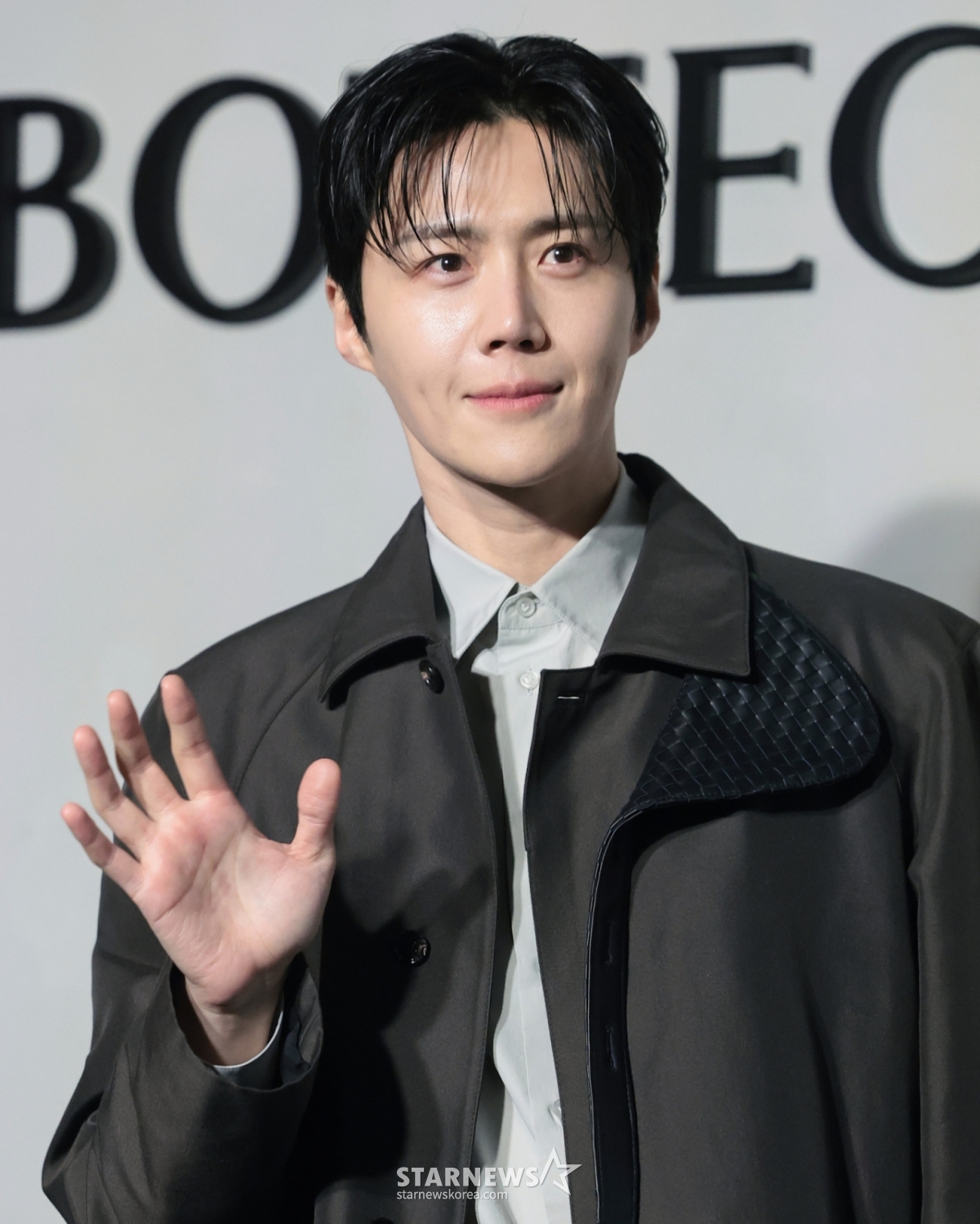

Actor Kim Sun-ho, a member of boy group Astro and Cha Eun-woo, who is suspected of tax evasion of 20 billion won, and an actor who is working with his agency Fantagio. While he is also currently embroiled in suspicions of tax evasion, an incumbent lawyer and accountant pointed out the problems of Kim Sun-ho and his agency.

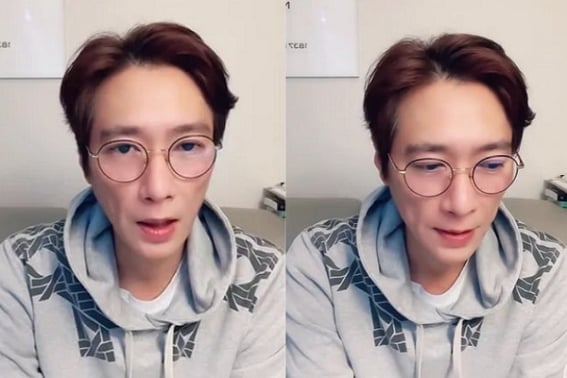

On the 2nd, lawyer and accountant Kim Myung-kyu said on his personal SNS, "Suspicions of Kim Sun-ho, the same agency, emerged even before the issue of Cha Eun-woo's 20 billion additional fine had cooled down. Again, it is about a single-person and family corporation, so a warning will be issued to the entertainment industry for the time being," he said.

He then said, "Suspected of establishing a corporation at home, spending living expenses with corporate cards and giving false salaries to parents, executives, were raised. The agency said, "I made it for theater activities, not tax evasion, but it is closed because I have no business activities," but the explanation is a little dangerous. I think it's self-inflicted."

According to Kim Myung-gyu, if there were no business activities, there should be no business expenses. If the corporate card is scratched and the salary is paid to the parents during the one-year period when the business stopped, the money becomes a non-business expense (provisional payment) under the tax law. In other words, the agency opened up room for itself to be interpreted as a private embezzlement and breach of trust. He said, "The provisional payment doesn't just end at the level of 'I borrowed money, so refill it'. "If money went out without substantial business activities, the National Tax Service will dispose of bonuses that the CEO, including Kim Sun-ho, considers to have received bonuses," he explained.

In addition, Kim Myung-kyu said, "Putting a sign does not mean that the data and records of the National Tax Service will disappear. Rather, the timing of closure can be a good opportunity for tax authorities to take a look at the flow of funds. Rather, the explanation that "I'm closing the door because I'm not working" can be an invitation like "Come in to investigate," he said. "In the end, the key is substance." You should properly explain whether you really planned the play, whether your parents really worked, through plans, meeting records, and work logs. If the explanation is not made, the explanation could be a spark to raise suspicions of tax evasion into a controversy over embezzlement and breach of trust. I'm worried that the agency is making a complacent judgment, saying, "How can you think this much?"

Kim Sun-ho, like Cha Eun-woo, is currently suspected of tax evasion by running a family corporation. It is known that the performance agency was listed at the home address in Yongsan-gu, Seoul, and the parents were named as an in-house director and auditor. In addition, the controversy is growing further as Kim Sun-ho was found to have transferred the amount to himself after paying his parents a salary.

In this regard, Fantagio explained on the 1st, "In the past, a single-person corporation was established for theater production and theater-related activities, and was not established for the purpose of intentional tax savings or tax evasion."

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.