*This content was translated by AI.

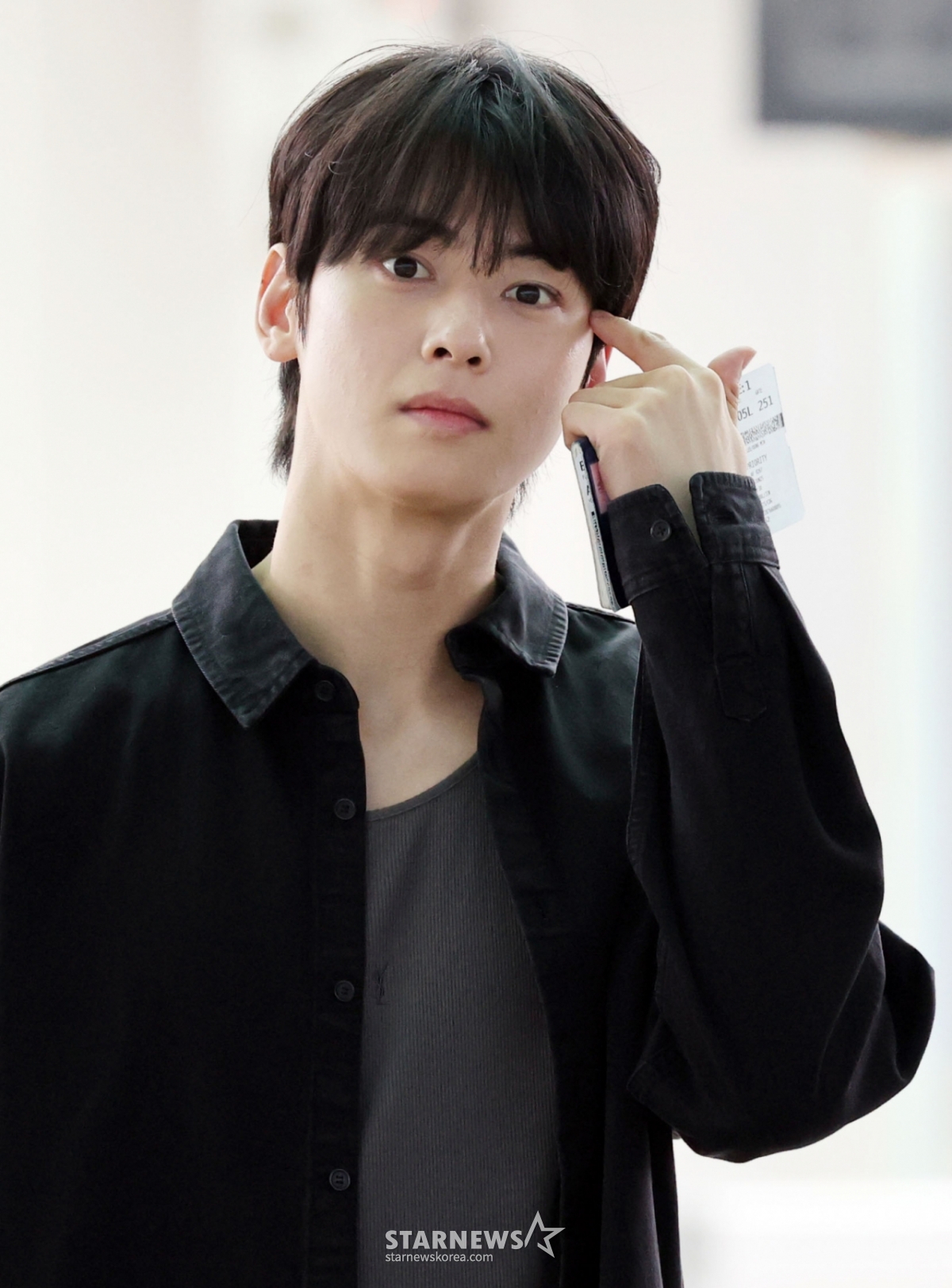

Amid allegations of tax evasion after singer and actor Cha Eun-woo was recently notified of tax collection worth 20 billion won by the National Tax Service, the civic group Korea Taxpayers' Federation said it would file a complaint with the police against a tax official who leaked related information and a reporter who first reported it.

The Korea Taxpayer Federation said in a notice on the 9th, "In connection with the leak of actor Cha Eun-woo's tax information related to the tax investigation to the media at 11 a.m. on the 10th (tomorrow), we will file a complaint with the National Police Agency's National Investigation Headquarters on charges of violating the Personal Information Protection Act and leaking official secrets under the criminal law."

The Korea Taxpayer Federation is a civic group established in 2001 to protect taxpayers' rights and interests.

When Cha Eun-woo was previously notified of the tax collection of 20 billion won, the Korea Taxpayers' Federation said, "The leakage of tax information by the National Tax Service can cause irreparable damage by honorally killing a celebrity as an unscrupulous tax evader," adding, "The leakage of tax information violates the right to object to unfair tax imposition and violates the principle of innocence guaranteed by the Constitution. If tax information is leaked, the state's tax base will collapse, making it difficult to recover the damage."

"This is not to defend or defend Cha Eun-woo, but in any case, it is to protect the community by protecting the tax base, which is the basis of the country, by establishing trust that taxation information is safe," he said. "False reports that kill the honor of popular celebrities who promote national prestige with K content are a great loss nationally and a great sadness for fans who love celebrities."

The Korea Taxpayers Federation said, "The causes of the collection are various, including the mistakes of the customs office, taxpayers' mistakes that are not likely to be blamed (simple mistakes, differences between corporate and tax accounting), and intentional mistakes that are likely to be criticized. It is not possible to know what wrongdoing the third party is and is not in a position to judge. The issue will only be confirmed through administrative and judicial procedures in the future, he added.

They also told the National Tax Service, "Immediately investigate the leakage of tax information and punish those responsible," adding, "The government should introduce a punitive damage compensation system for damage caused by the leakage of tax information, and establish a clause in the Tax Offender Penalty Act that severely punishes those who leak tax information."

Meanwhile, the National Tax Service recently decided that Cha Eun-woo evaded income tax using a corporation in his mother's name, and notified him of an additional 20 billion won. In particular, the controversy was intensified as the address of the corporation was known to be the same as the eel restaurant located in Ganghwa-gun, Incheon, where his mother operated.

Cha Eun-woo, who is currently serving in a military band, said on his SNS, "With this incident, I am reflecting on myself and deeply reflecting on whether my attitude toward tax obligations as a citizen of the Republic of Korea was strict enough." In addition, we will humbly accept the results according to the final judgment made by the relevant agency and fulfill our responsibilities accordingly.

"The current issue is being investigated faithfully by the tax authorities' procedures, and the agency and artists are investigating faithfully within the scope of their respective needs," the agency Fantagio said. "If legal and administrative judgments become clear in the future, we will take necessary measures responsibly according to the results."

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.

![Kim Byung-se's reason for leaving Korea "Meet his wife, who is 15 years younger than him."Propose for 90 days" [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020908354384437_1.jpg)

![Choo Sung Hoon's daughter Chu Sarang, are you already independent..YANOSHIHO, "I won't support myself" [Star Issue]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026020918181376973_1.jpg)