*This content was translated by AI.

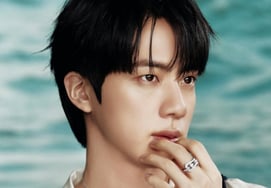

While singer-actress Cha Eun-woo is embroiled in allegations of income tax evasion in the 20 billion won range, a former National Tax Service investigator criticized his response.

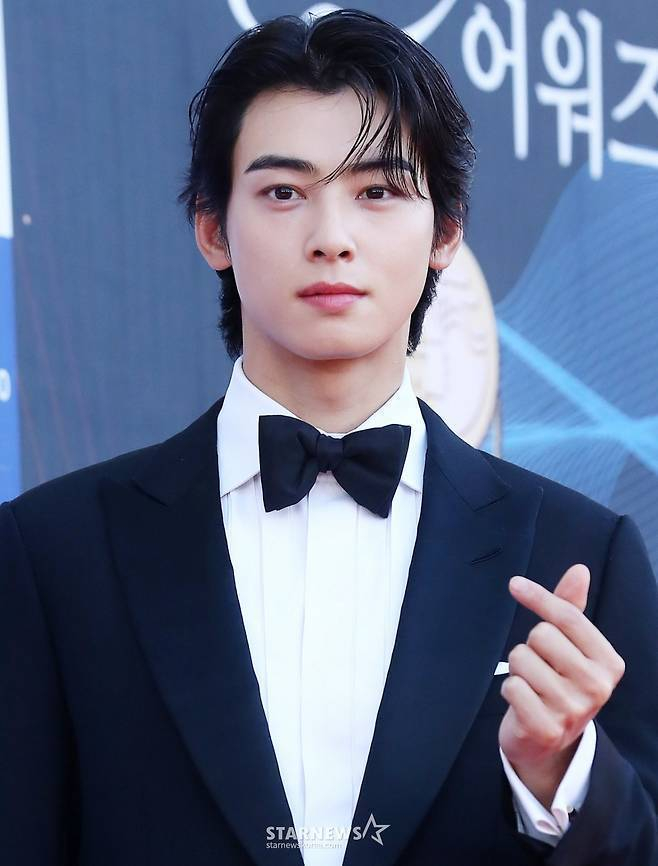

Recently, a video clip of Jeong Hae-in, a former tax inspector at the National Tax Service, analyzing the Cha Eun-woo controversy was posted on the YouTube channel "CIRCLE 21."

Regarding the Cha Eun-woo controversy, former investigator Chung said, "If it had been a normal corporation, the National Tax Service would not have done this," adding, "It is a story that the nature of the corporation is not recognized at all."

"We just set up a corporation to reduce individual income taxes. One-person agency is not actually used for the activities of this corporation, but only borrowed the shell. "That's not what the substance is," he analyzed.

He also said, "It is fortunate that (Cha Eun-woo) is not accused," adding, "The investigation bureau 4 basically conducts the investigation with the accusation in mind." If you judge that it is legally tax evasion, you may become an ex-convict through a tax evasion," he claimed.

As for Cha Eun-woo's agency Fantagio, he said, "I think the method is wrong. It is faster to admit a mistake. This response ultimately undermines the image," he pointed out.

Meanwhile, in the first half of last year, Cha Eun-woo was under intense investigation by the Seoul Regional Tax Office on tax evasion charges, and the National Tax Service recently notified about 20 billion won in tax collection.

The National Tax Service judged that tax evasion was carried out through corporation A established by Cha Eun-woo's mother. Cha Eun-woo reportedly worked in a structure in which his agency Fantagio and his mother's corporation A signed a service contract to support entertainment activities, and the profits were divided and attributed to Fantagio, the corporation, and Cha Eun-woo.

The National Tax Service believes that corporation A was deemed inappropriate to perform entertainment management tasks and used a trick to disperse income through a non-substantial "paper company." Cha Eun-woo signed a service contract with a separate family company in addition to his existing agency Fantagio, which was applied with a lower corporate tax rate of more than 20 percentage points instead of the income tax rate of 45 percent.

The core of this controversy is whether corporation A is involved in Cha Eun-woo's profit distribution process. In addition to the fact that the entity of the corporation is an "eel restaurant" run by Cha Eun-woo's mother amid the controversy, Cha Eun-woo has been revealed to have introduced the eel restaurant as a "dangol restaurant."

In response, Cha Eun-woo said on SNS on the 26th of last month, "I sincerely bow down and apologize for causing many people to be worried and disappointed by various things related to me recently. "With this incident, I am reflecting on myself and deeply reflecting on whether my attitude toward the duty of tax payment as a citizen of the Republic of Korea was strict enough," he said.

In addition, Fantagio said, "The main issue is whether the corporation established by Cha Eun-woo's mother is subject to real taxation," adding, "It is not currently finalized and announced, and we will actively explain issues related to legal interpretation and application in accordance with due process."

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.

!["Jeong Sia ♥." Baek Do-bin said, "I gave up my acting career, raising children.."I have no regrets" [Asijeong]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020807021157012_1.jpg)

!["Ham So-won's ex-husband." Jin-hwa is shocked by her daughter Hye-jeong's confession.."You fight with your mom every day" [Dongchimi ★ Night TV]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020800064230333_1.jpg)

![Bae Sung-jae pays '500 million won' for Olympic broadcasting.."Isn't it almost juicy?"" ["Knowing Bros" "Byul Byul TV"]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020721063387179_1.jpg)

![Lee Sang-yoon, a physics major at Seoul National University, said, "I don't trust AI..I'm afraid I'll be taken over by machines" [Omniscient Interfering ★ Night TV]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=567,h=378,fit=cover,g=face/21/2026/02/2026020800391623335_1.jpg)

!['44-year-old' Park Eun-young, second, living in a luxurious cookhouse after natural delivery, "It's like heaven." [I don't know if you know or not]](https://thumb.mtstarnews.com/cdn-cgi/image/f=auto,w=271,h=188,fit=cover,g=face/21/2026/02/2026020808113178067_1.jpg)