*This content was translated by AI.

Since listed stocks have prices that are traded on the market every day, it is not difficult to calculate their value. However, unlisted stocks without exchanges are different. When shareholders have conflicting interests or when opposing shareholders exercise their right to claim shares in the process of reorganizing the company, such as mergers and divisions, the "fair value" of the stock is always at the center of the dispute.

Let's look at the stock purchase price determination non-transmission case, which corresponds to the solution in this case, and the specific value calculation method and appraisal practice.

Non-transmission procedure for determining stock purchase price

If there is no agreement between the parties on the valuation of unlisted stocks, it will be resolved as a non-government case under the Non-government Case Procedure Act, not as a general civil lawsuit (Articles 1 and 2 of the Non-government Case Procedure Act).

This procedure is mainly used when shareholders exercise their right to claim stock purchases against reorganization such as mergers and divisions (Article 374-2 of the Commercial Act), and when shareholders request a purchase because the company does not approve the transfer under the articles of association (Article 335-6 of the Commercial Act), and the competent court is the district court where the company's headquarters are located.

The non-transmission procedure has more discretion, such as allowing the court to investigate evidence ex officio, so it can flexibly cope with finding substantive truth and calculating fair values than general lawsuits, which emphasize strict burden of proof.

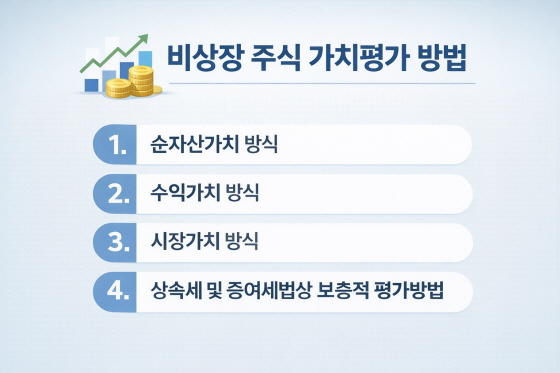

How to Validate Unlisted Shares

The court tends to prioritize objective exchange value when evaluating the value of unlisted stocks.

If the market price exists (Transaction Case Act): If there is a normal transaction example, it is a principle to view the transaction price as the market price. However, transactions between related parties with a small number of shares or sudden sales excluding management rights premiums are difficult to be recognized as market prices.

Universal evaluation method when there is no market price: When there is no transaction case, the following methods are mixed in consideration of the company's situation and the characteristics of the industry.

The net asset value method is a method of dividing the net asset of a company by the number of issued stocks minus liabilities. It is useful when the asset is clear, but it has the disadvantage that it is difficult to reflect intangible assets such as goodwill or technology.

The revenue value method converts earnings expected to be generated in the future by discounting them to present value. It excels at evaluating a company's sustainable growth potential.

The market value method is calculated by comparing the stock price of a listed company with a similar industry or financial structure or by multiplying it by a certain multiplier.

Supplementary evaluation methods under the Inheritance Tax and Gift Tax Act (Inheritance Tax and Gift Tax Act): One of the most widely cited standards in practice is Article 54 of the Enforcement Decree of the Inheritance Tax and Gift Tax Act. In the case of general corporations, the value is calculated by weighting the 'net profit or loss value and net asset value at a ratio of 3:2'. In special cases, such as corporations with excessive real estate holdings, it is sometimes evaluated only by net asset value.

The importance and practical issues of appraisal procedures

Courts usually designate accounting firms or appraisal firms as appraisers in order to secure expertise in calculating stock values. The results of the appraisal are the decisive basis for the court's judgment unless there is a significant fault lacking rationality. There is an advanced technique mainly used by appraisers.

①Cash Flow Discount Act (DCF): Estimate future cash flows and apply appropriate discount rates. It is logical, but there is a lot of room for subjectivity to be involved in the estimation.

②Similar Company Comparison Method: Use indicators of listed companies in the same industry.

③Management rights premium: In the case of the largest shareholder's stake, an addition of about 20% may be considered under the Tax Increase Act, which is often a key issue in disputes.

④Practice Notes for Successful Response: In order to win the unlisted stock dispute, the following factors must be carefully prepared beyond simply substituting them into the formula.

The result value varies depending on the setting of the evaluation base date = the date of exercise of the stock purchase right.

Verification of the reliability of financial statements = Non-executives often have unclear accounting treatment. It is essential to closely grasp and adjust the signs of provisional payments and fraudulent accounting.

Emphasizing the characteristics of the industry = You should convincingly present to the court an evaluation model that is favorable to you, such as emphasizing the value of profits for IT startups and net asset values for real estate developers.

It is worth noting that unlisted stock valuation is not a mathematical problem with a fixed answer, and the court's judgment is a process of finding "specific validity" by synthesizing various evaluation factors.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.