*This content was translated by AI.

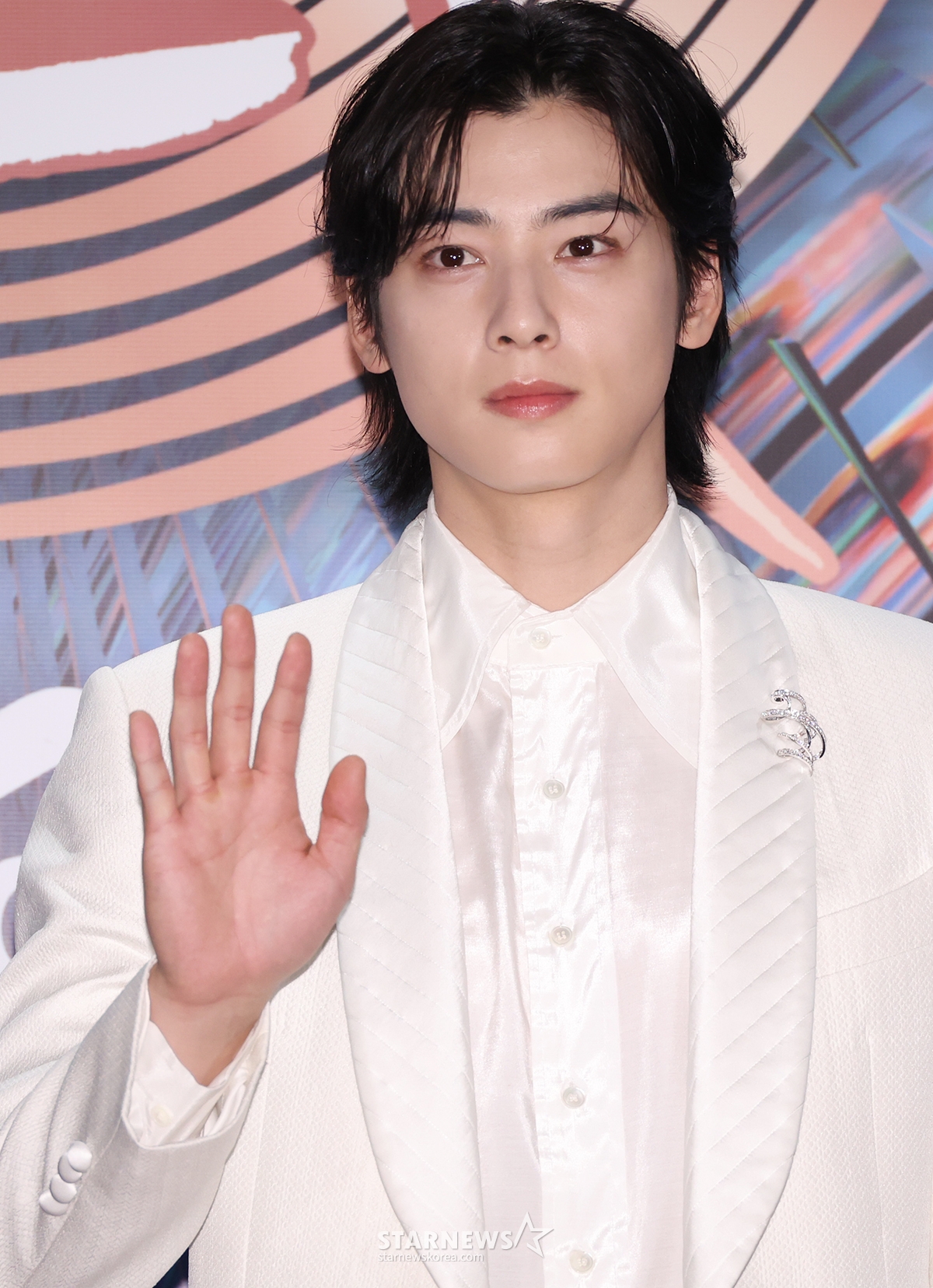

The Korea Taxpayer Federation (Chairman Kim Seon-taek) raised its voice in connection with the controversy over tax evasion of 20 billion won by Cha Eun-woo (29, real name Lee Dong-min), a member and actor of the group Astro, saying, "The principle of presumption of innocence should be observed." The Taxpayers' Federation is the only tax-specialized civic group in Korea that conducts activities to protect taxpayers' rights.

The Taxpayers Federation said on the 29th, "Tax avoidance is a taxpayer's right," adding, "If tax evasion is successful, it becomes 'tax saving', and if it fails, it becomes 'tax evasion'. The U.S. Supreme Court issued a statement saying, "The legal right of taxpayers to reduce or avoid taxes to be imposed on them to the extent permitted by law can never be questioned."

"It is against the principle of presumption of innocence to drive a corporation in the name of Cha Eun-woo's mother to a 'paper company,'" the Taxpayers' Federation said. "In the case of the domestic mother chicken brand, the National Tax Service accused the son's company of being a 'paper company' without human or physical facilities, and was convicted in the first trial, but the Supreme Court ruled him not guilty."

Nevertheless, the Taxpayers' Federation said, "It is contrary to the presumption of innocence that the media categorically calls the corporation a 'paper company', and there is a high concern that it will infringe on taxpayers' rights by forming a prediction in the process of objection and litigation," and emphasized, "The basic principle of the criminal law, "Even if there is a limit to releasing 100 criminals, we should not create a single unfair person."

In addition, the Taxpayers Federation said, "It is illegal to leak tax information," adding, "Information related to celebrity tax audits is difficult to report without the leakage of tax information by tax officials. It is a dereliction of duty for the head of the National Tax Service to sit on the sidelines without investigating whether it has been leaked. The National Tax Service should search for public officials who leaked tax information through strict self-audit and punish them."

The Taxpayers Federation said, "The equation of 'tax collected = should be criticized' does not hold. Rather, the National Tax Service should be criticized for creating a tax law that is difficult for even experts to understand and not sufficiently guiding it in advance. It is an honor murder out of ignorance to accuse a tax evader simply because he has been fined," he said.

In July last year, Cha Eun-woo was notified of a tax collection of more than 20 billion won after undergoing a high-intensity irregular tax audit in the Seoul Regional Tax Office.

<© STARNEWS. All rights reserved. No reproduction or redistribution allowed.>

*This content was translated by AI.